Money is a surprisingly difficult thing to understand. In 2003, Second Life launched and included as a critical feature a digital currency designed to enable people building digital goods in the rapidly growing world to trade them with each other. Over the last 20 years, tens of billions of dollars have changed hands there, and as a result I/we got a crash course in how money actually works. As a result, I think about money a lot. I’m currently in the process of building a new kind of digital currency, built on many of the discoveries we made trying to help avatars from all over the world buy and sell things from each other in a way that was generally regarded as fair.

“Trust” is a word that is thrown around liberally in the discussion of money - it is even printed on our bills. Crypto uses it in reference to software… “in code we trust”. But the sort of trust I am talking about in this essay is the human, personal “I trust you” kind. A concrete example would be when you pay for a friend’s lunch, trusting that they will pay for yours next time. So if you trust your friend, you buy them lunch.

Cryptocurrency is interesting in that it started with the premise “no one can trust anyone”. As a side note: this was certainly an understandable perspective, given that it was immediately after a financial disaster in which US banks stole hundreds of billions of dollars and homes from helpless US citizens, perpetuating a global financial crisis for which they did not take responsibility and in the end actually profited from. But I digress.

Rather than trusting the government (or anyone else) to print money, Bitcoin began with the premise that you must trust no one. The goal was to provided a fairer, people-powered alternative to a broken system (US Dollars), but how could they be distributed in a better way? Trusting no one, Bitcoin’s designer was faced with a problem: How do you give out bitcoins?

Instead of agreeing on some initial allocation (which would have required some sort of trust - minimally that each person created only one account), the designers opted to create a contest where a fixed number of bitcoins would be gradually given out to the people with the fastest computers. This is fair and sensible the same way having little kids arm-wrestle over who gets the larger slice of pie for dessert is fair: It isn’t.

Allocating bitcoins by computing power might at first seem vaguely egalitarian, since most people (or at least “wealthier people in western countries”) have a good desktop computer, don’t they? So its sort of like giving out the coins equally to people with computers, right? But now consider that this process of giving out coins is going to go on over a lengthy period of time, and you realize something: The person who gets more bitcoins early in the contest will re-invest their money in more computers, giving them even more bitcoins, and so on.

And after all the fighting is over and all the coins are given out, who will have won? Why the one with the most money at the start, of course! This was the person who has the greatest excess cash to buy their mining computers at the earliest possible moment, and further able to fully re-invest their profits in new computers. So what we actually ended up with is a very unequal distribution of bitcoins to a small number of people.

Ah you say, but what if you are using Ethereum? It’s different, right? Nope - same problem. To their credit, Ethereum developers recognized early on that “proof-of-work” devolves over time to “give the money to the richest person”. And so the Ethereum designers switched over to a strategy called “proof-of-stake” which is a fancy term for saying “everyone put money in a hat, and we will give the new coins out in proportion to how much money you have in the hat”. This approach very directly gives the money to the wealthiest people, but without the extra environmental impact of also playing the bitcoin computer-power-gambling game. So Ethereum is an improvement with respect to environmental impact, but not to fairness. The money still goes directly to a small number of rich people.

But you might be thinking “over time, things even out, right?”. Actually, they don’t. Strangely and unfortunately, free market trading always increases whatever initial inequality exists in a distribution… or as they say “the rich get richer”. The mathematics of this are complex and fascinating enough that myself and many others have written extensively about it. In a nutshell, things don’t even out over time, even if everyone is well-intentioned and equally valuable to each other.

So the first and biggest way cryptocurrency prices distrust is by this profoundly inequitable distribution. If we aspire to have Bitcoin be a great equalizer here to serve all humanity (as we should), you would expect that each living person (about 8 billion of us) would have a roughly fair share of them - and in fact at today’s price we’d each have about 140 dollars worth. But we don’t - the distribution of bitcoins is even more unequal than the distribution of dollars, and only getting worse.

A second way cryptocurrency prices distrust is the fees associated with transactions. Because no one trusts anyone, everyone has to keep an exact copy of all the payments that have ever been made, so that when someone tries to cheat, everyone else can catch them. Having everyone keep a full copy of all the records makes the system very expensive to run, which is expressed in the high transaction fees that one has to pay to make a payment. Worse yet, these fee are fixed and therefore regressive - meaning those with less money shoulder a larger portion of the burden.

A third way that cryptocurrency prices distrust is in lost passwords. Because you can’t trust anyone (no banks or governments or even friends to help you), you have to keep your password safe and not lose it. But humans do lose things, and it is estimated that between 10 and 20 percent of all bitcoin has already been lost in this way. That a pretty high tax on people who hate taxes! And it’s your aging parents who need it the most that are going to lose theirs first. I guess a silver lining for inequality could be that when people die they are probably less likely to be able to transfer BTC to their kids - a kind of higher effective inheritance tax.

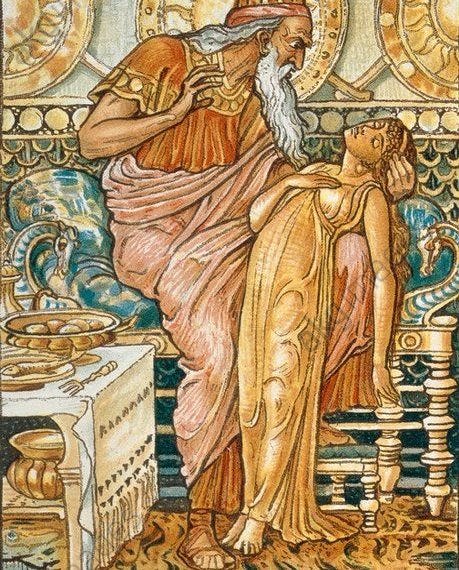

With respect to distrust, cryptocurrencies and gold are actually quite similar. As King Midas discovered, coveting and hoarding gold as the only means of trade comes at a high price to yourself and everyone around you. And in fact - contrary to what most of us were taught in school - when gold was used over most of history for trade it was not to trade with neighbors or even with neighboring villages. It was mostly used by traveling merchants visiting faraway lands, as a commodity of last resort. Even though it was hard to get and not widely distributed (like bitcoin), everyone felt that gold was worth something. But having to fall back to gold for trade meant that you first had to exchange your goods or labor to get some of the gold. If gold wasn’t widely available for mining in your area, or held by a miserly king, you might find it very expensive to get ahold of some. In this regard the crypto bros and the gold miners and the bankers are the same - they are the ones you have to turn to if you can’t trust anyone else.

But what is the better alternative when you actually can trust the people you are trading with? Just like your friend at lunch, if you can trust a group of other people, you can create a token currency with them. In the case of lunch with a friend you basically just keep a simple ledger in your head - with an entry something like “Last time, I bought Alice a sandwich and a beer”. But you can do this with a larger group and written ledgers in a similar way. Imagine a shared google sheet among a large group of friends, with a bunch of entries like “Philip paid Alice $40 for advice”, “Alice paid Bob $100 for tennis shoes”, “Bob paid Philip $40 for lunch”, and so on. You can total up the balance of each person as the sum of what they’ve received minus the sum of what they’ve paid to others. If anyone goes too negative, the community can warn them to get a job (or otherwise transfer more value to others), or even stop trading with them. In this way, you can have a money system without gold, or banks, or bitcoins… basically a bunch of IOUs that are passed around.

Is the idea of a trust-based currency some weird utopian thing dreamed up by techies? While the banks and bitcoin holders might want you to think so, it turns out that economies based on trust and IOUs are the most common historical systems, far pre-dating the emergence of gold coins or ‘fiat’ currencies issued by governments. If you want to learn more about the various types of trust-backed currencies, start with this Wikipedia entry on Mutual Credit.

So, in summary, trust can be used directly as a basis for an economic system whose cost to participants are lower than when using gold (or bitcoins). Trust can be converted into money. And perhaps that was the deeper meaning of the story of Midas.

Karma is exactly what you are talking about. A bunch of IOUs. If you think that blockchain is too expensive, it is possible to store the current debt list in a Merkle tree and store the Merkle roots only on a daily basis validated by zero-knowledge proofs. Like a zkRollup. This is a storage-efficient and cheap solution secured by the blockchain (you get the same level of security if the state is stored at the end of the day).

Karma: https://medium.com/better-programming/karma-an-erc20-compatible-alternative-money-on-the-ethereum-blockchain-cee660b821ce

zkRollups: https://medium.com/coinmonks/how-to-implement-a-minimalist-nft-zkrollup-b93fd4e326ad

One of my favorite theoretical economies was the one described 'Critical Mass' by Daniel Suarez (part 2 in the Delta V series). Essentially a space economy that didn't allow the direct transfer of 'old money' to 'new money'. Anyone could earn this 'new money' via programs similar to carbon credits/capture.

So I'm curious, what opportunities can we create with a new currency that helps to redistribute wealth? How are those doing the most good for society and the environment are the most rewarded?