Why do The Rich Get Richer?

It is easy to think that government or policy choices cause the rich get richer, but that's not the reason. The rich actually always get richer, no matter what. It's a basic law.

Richard Feynman was great at explaining complicated ideas from Physics in a way that everyone could understand. He said that if you couldn’t explain something clearly and using small words, you probably didn’t understand it very well yourself.

Economics is complicated because it involves lots of transactions between lots of people that when you add them all up together you get some answer, such as how many rich people versus poor people there are. This is the same as how in physics you have things like a gas law that tells you (for example, under certain conditions) that if you make the volume of something twice as big, the temperature will go down by half. The gas law tells what will happen, but if you look really closely at the gas you will find that it is made up of little molecules bouncing around. And the collisions between these molecules don’t individually have anything to do with gas laws - they just run into each other and bounce off with certain rules, like conserving energy. But if you simulate a whole lot of molecules that way, and add up the forces on the sides of the box and how fast they are moving, you end up with pressure and temperature and those gas laws. Economics is like physics that way, but instead of molecules you have people who run around and bump into each other and make various kinds of transactions. The transactions have the same sort of fundamental rules - you can require that they conserve the total amount of money in existence, for example. As something of a side note, economics is problematic in a way that physics is not because individual people do much less predictable things than molecules when they bump into each other.

So I want to show you a way to see how the rich get richer, simply by simulating lots of people bumping into each other and making transactions. I wrote this simulation in Processing, and you can play with it yourself through the link at the bottom of this post.

Consider a group of a couple hundred people, wandering around in a big town square, where initially everyone has the same amount of money. Whenever two of them run into each other, they make a transaction. To make these transactions random and unbiased, imagine it goes like this: Pick a random amount of money that is less than the amount held by the poorer of the two. Then flip a coin to determine who gives that amount to the other. That’s all there is to it. In the real world we would imagine that the seller gave in return some good or service of the same value to the buyer, but for the purpose of analyzing how wealth moves around over time, we don’t need to bother with that. When you start the simulation, it looks like it does in the picture below, with everyone having the same amount of money:

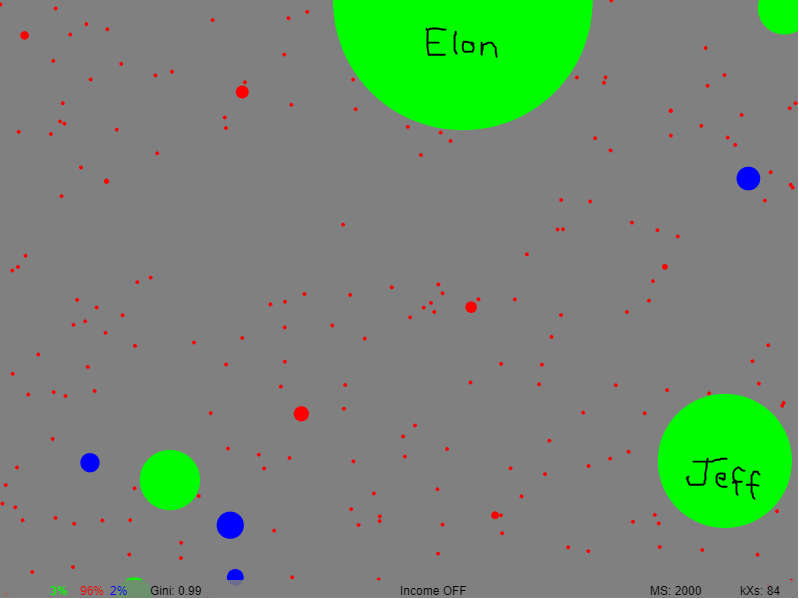

But let it run for just a few minutes, and things look very different! Of 250 people, 5 rich ones have all the money (green), and 96% of the population is poor (red). We can call that big one ‘Elon’. The Gini Index is shown at the lower left, which is a widely used way of measuring wealth inequality. Zero means that everyone has the same amount and 100 means that one person has all the money. In the real world, the Gini index of The Netherlands is 28, for the USA it is 48, and for Chile is 44. For our simulation, after only a few minutes, it is 99! So how is it that the rich got so rich, given that the transactions described above seem so random?

The answer has to do with the low-level rule for transactions which we described above. Specifically, the problem is the requirement that the amount of money to be risked (or gained) is no more that the balance of the poorer person. What this means is that the poor can gain no more than their own value in a transaction, where the rich stay rich because no one transaction will measurably decrease their spending power. Putting it another way: all else being equal, the person with more money going into a transaction will (statistically speaking) come out on top.

This is a difficult thing to get your head around, but of course trivial to show in the simulation. Each individual transaction may seem ‘fair’, but over a large number of transactions, the rich just keep getting richer! And this is exactly what we see in the real world. In a situation where everyone gets to keep their wealth indefinitely (or for a fairly long time), one person will very quickly end up with all of it. It doesn’t require monopolies, oligarchies, or even indifference to create dramatic wealth inequality - it only requires ordinary well-intentioned people buying and selling things from each other in an open market. Once you get poor you stay poor, because you have little to trade.

You may have noticed the “Income OFF” statement at the bottom. That is the topic for the next post, which will be about how basic income and taxes can create a stable world with a healthy balance between rich and poor.

If you’d like to see this simulation run or inspect the code, you can go to this link and hit the ‘Play’ button to see the rich get richer all for yourself.

Insightful simulation! Now, how can we evolve the algorithms so that the richest is less than twice as rich as the poorest? What does that mean for both individual and societal wealth? How does that affect behaviour? Also, what is the total money volume transacted? It’s not about how much money one owns, it’s about creation of value. So if every transaction creates some kind of value for the buyer (and maybe satisfaction for both), we might be better off shifting focus on value/happiness creation, away from money owning, and visualise that instead.

Beautiful piece of simulation! It's interesting that what appears to be "fair" is actually biased. Certain parties in the UK (not naming names) often advocate a proportional tax, because it's fair if we all pay 30%, right? Well no, because if wealth grows exponentially, it needs taxing exponentially! However, I added a method to your code called "maybeTradeProportionally" and if you hit the trades themselves proportionally, so that both parties risk a roughly equaly proportion of their wealth, you get something that looks very Gaussian in the long run, and hence actually fair, not the fake fair that your code so beautifully shows! Here's my addition:

https://editor.p5js.org/benTriesToCode/sketches/q6bjT8fzT