Printing Money Doesn't Help

Even printing new money and giving it to everyone won't actually help - the rich still get richer.

In the last post, I showed a simulation illustrating the low-level problem with free markets - that the rich always get richer: When otherwise identical people trade randomly with each other but can only spend (or gain) as much as they have, wealth shifts quickly from everyone initially being equal to a handful of lucky people having all the money and everyone else being poor. Even without banks charging interest, or monopolistic companies, or stock markets, it still happens. All economic systems with free markets exhibit this problem, and will eventually concentrate all the wealth in the hands of a few. If we believe that there is value in free markets (and without debating it here I will simply asset that the answer is yes), it would be great to find a mechanism other than violent revolution or the collapse of society that can counter this outcome.

So how do we fix wealth accumulation? For a community to avoid runaway concentration, it must act in some way to continuously redistribute wealth. This could be done in a number of ways, and you can easily test them by editing this simulation code.

The Gini Index1: In this simulation I measure and display the Gini index, which is a widely used way of measuring wealth inequality in a population. A Gini index of zero means perfect equality - everyone has the same amount of money. A Gini index of 100 means that one person has all the money, and everyone else has none. Europe has a Gini index of about 30, the USA has more inequality, with an index of 43.

In this post I want to simulate what would happen if we just started printing money and giving it to every in equal amounts. This is similar to a ‘universal basic income’, where the money is printed rather than funded by taxes or other programs. I am not simulating foreign trade or other complex secondary effects associated with increasing the money supply. But what emerges in the simulation is that printing money doesn’t help - the rich stay just as rich.

To explore this, run the simulation and then click in the main window to turn on and off the printing of money. You will see that when you start printing money, there is brief period where inequality decreases and the Gini index drops - but then quickly begins to climb again. Let’s take a look:

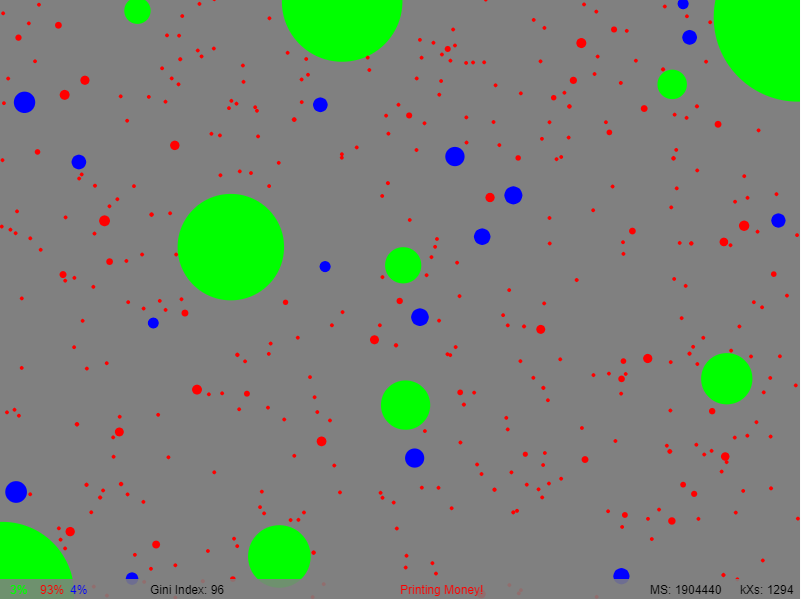

The image below is the simulated world of 400 people after about 250,000 transactions. As you can see, wealth inequality is disastrous: the Gini index is 99, everyone is poor, and 11 very rich people have all the money. How long did that take? Comparing time to the western world, where consumers make about 2 transactions per day2, that would mean that this level of wealth inequality would be reached in about a year. Yikes.

Next, we sweep in like heroes and hit the “MONEY” button - giving everyone (rich and poor) a regular infusion of newly printed money. Initially we are delighted because within a few months of real-world time, we have a dramatically more equal distribution of wealth with a Gini index approaching present-day USA (not that this should be our target, of course):

But then, a strange thing happens! Even with money printing left on, wealth inequality continues to increase again, until about three years later we are back to where we started!

What happened? The explanation is that even if you give everyone the same amount of new money, the richer people still get a larger proportion of that new wealth - and if you wait long enough, things get right back to the worst case scenario. Printing money does slow the process down (from a year to a few years, in this simulation), but it can’t stop the inevitable creation of a fortunate few ultra-rich.

This is something to consider as we look at how to fund various basic income programs: this simulation suggests that if they were to be funded purely by inflation, we would probably not get the outcome we want.

Try it out yourself by playing with the simulation. Press Play to start, and click anywhere to turn on and off the printing of money. Edit the ‘new_money’ variable in the code to change the size of the basic income.

But don’t lose hope! In my next post, I will show a simulation that results in a more equitable distribution of wealth over the long term, and further suggest how such an economy could be achieved in real life with a suitably designed cryptocurrency.

https://en.wikipedia.org/wiki/Gini_coefficient

https://www.ngpf.org/blog/payment-types/whats-the-number-of-consumer-payments-made-in-a-typical-month/